Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has introduced a new initiative enabling customers to invest in the UAE equity markets at zero transaction fees, thereby encouraging the growth of domestic stocks and boosting economic growth in the country.

The bank’s recent initiative is in line with the nation’s ‘We the UAE 2031’ vision, focussing on enhancing the position of the UAE as a global partner and an attractive and influential economic hub.

By offering customers an opportunity to invest in the UAE equity markets, Emirates NBD strengthens the bank’s ongoing commitment to support the UAE’s economy and economic agenda. Emirates NBD continues to work closely with the UAE’s government, regulators and the private sector to boost the nation’s global standing as a key global investment hub.

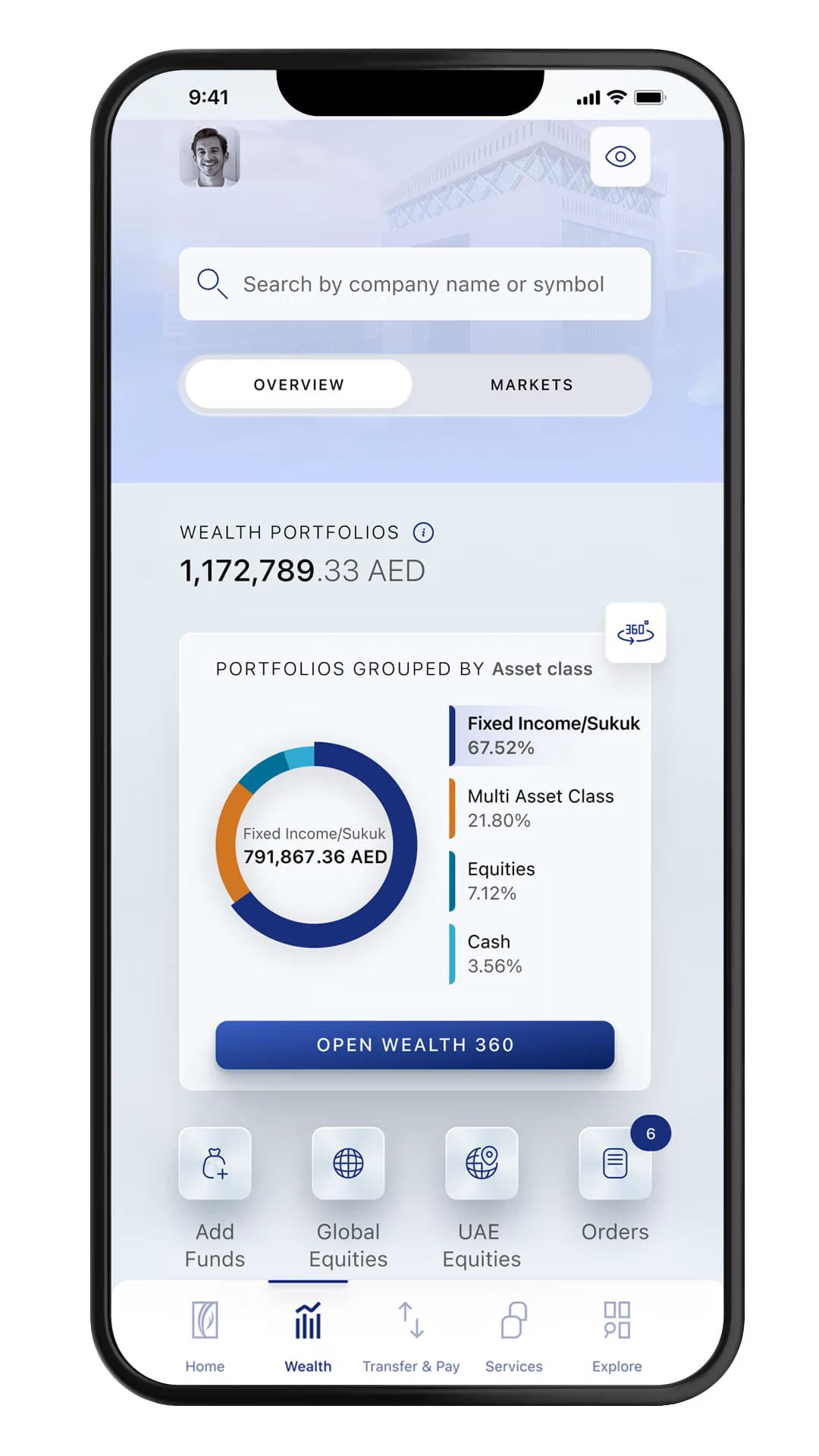

Emirates NBD customers can conveniently explore and trade local equities for free, using their everyday mobile banking app, ENBD X, with more than 150 regional equities available to trade on the platform.

Marwan Hadi, Group Head of Retail Banking and Wealth Management at Emirates NBD, said: “Emirates NBD continues to finance the real economy of the UAE and contribute to the long-term economic growth and development of the region. As a leading national bank, we continue to introduce beneficial initiatives that advance the financial prosperity of our customers. Our new initiative not only provides investors access to local equity markets, but also allows them to explore and invest in domestic stocks at no cost, presenting an opportunity to diversify their portfolios.”

He added: “Investing in domestic stocks contributes directly to the success of local businesses and domestic companies, thereby supporting the growth of our national economy and aligning with the bank’s commitments and goals.”

Emirates NBD’s digital wealth platform allows customers to trade securities on both global and local exchanges. Overall, there are more than 11,000 global equities and 150 regional equities available to trade on the platform.

Since its launch last year, the bank continues to enhance its one-of-a-kind wealth platform, on its mobile banking app ENBD X. Earlier this year, the bank announced the launch of fractional bonds on the platform, marking a pivotal moment in its journey towards increasing access to financial markets.

Besides allowing customers to conveniently invest and trade in complex financial instruments from the same app that also fulfils all their everyday banking needs, the platform also offers a unique Secure Sign facility, where customers with high trading volume can update and sign investment documents to complete any trade irrespective of its complexity or value.

Follow Emirates 24|7 on Google News.